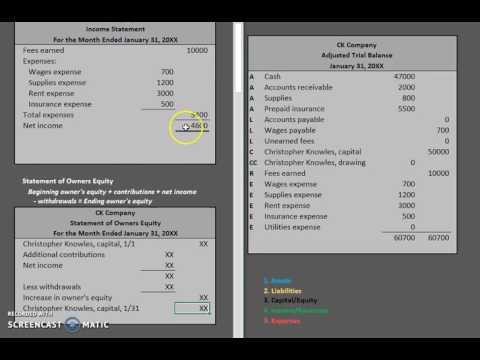

Subtract gains related to financing, like interest received, and add back financing expenses or losses, like interest paid. Once you have the closing balance for the retained earnings account, add it to the opening balance of owners’ equity. The old-school method was to record these transactions in a journal; however, using accounting software means you can just enter transaction details into the accounting system – the system takes care of the rest. Financial statements are important because they give a clear picture of how well a company is doing financially at a particular point in time.

Related AccountingTools Courses

Investors, lenders, and vendors might be interested in checking out your business’s cash flow statement. That way, they can see whether or not your company is a good investment. Read on to learn the order of financial statements and which financial statement is prepared first. You may notice abc analysis abbreviation that dividends are included in our 10-column worksheet balance sheet columns even though this account is not included on a balance sheet. There is actually a very good reason we put dividends in the balance sheet columns.

No matter what the puzzle looks like when it’s done, Expensify is here to be your co-pilot on this financial journey. With expense reporting features designed to streamline and simplify, Expensify makes the process less daunting, freeing up your time to focus on what you do best — running your business. The FASB is a private organization responsible for establishing and maintaining accounting standards in the United States. It develops GAAP and ensures that these standards are regularly updated to reflect evolving business practices and economic conditions. This process involves combining the financial information of the parent company and its subsidiaries to present a unified view of the entire corporate group’s financial position and performance. Your cash flow might be positive, meaning that your business has more money coming in than going out.

Which financial statement is prepared first?

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- Audit opinions are the conclusions auditors reach after reviewing a company’s financial statements.

- The balance sheet, also known as the statement of financial position, presents a company’s assets, liabilities, and stockholders’ equity at a specific point in time.

- These components provide a comprehensive view of a company’s financial position, performance, cash flows, and changes in equity.

- Consistency is the practice of using the same accounting methods and policies from one accounting period to another.

To create a trial balance, you just need to list the balances of all accounts in your books and sum up the debit and credit balances. Once you’ve double-checked that your statements are good to go, you’re ready to finalize the statements for reporting. Depending on the nature and size of your business, this step might involve getting them audited or reviewed by external accountants to ensure compliance with relevant standards and regulations. IFRS is a set of accounting standards developed by the International Accounting Standards Board (IASB) for use in over 140 countries. IFRS aims to harmonize accounting practices globally and enhance the comparability of financial statements.

Consolidation of Financial Statements (If Applicable)

Cash flow from investing activities includes cash received from the sale of securities and cash paid to buy new assets like land and equipment, among other things. Cash flow gives you insights into your business’s sources and uses of cash. Maintaining a healthy cash balance – aka, enough but not too much – is mission-critical. Shareholders’ equity is money that belongs to the company’s owners (equity shareholders) and preference shareholders. For example, if the company revalues an asset and it’s worth less, it’s the company’s loss.

Step 1 of 3

However, the loss is only realized when the company sells that asset. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The equity figure calculated when preparing the statement of changes in equity goes in this section.

Consistency is the practice of using the same accounting methods and policies from one accounting period to another. Accrual accounting is the primary method used in financial statement preparation. It records transactions when they are incurred, regardless of when the cash is exchanged. After you generate your final financial statement, use your statements to track your business’s financial health and make smart financial decisions.

This means revenues exceed expenses, thus giving the company a net income. If the explicit and implicit costs definition and examples debit column were larger, this would mean the expenses were larger than revenues, leading to a net loss. You want to calculate the net income and enter it onto the worksheet. The $4,665 net income is found by taking the credit of $10,240 and subtracting the debit of $5,575. When entering net income, it should be written in the column with the lower total. You then add together the $5,575 and $4,665 to get a total of $10,240.

You’ll need to subtract gains and add back losses on the sale of assets. Balances of fixed asset accounts like land, current asset accounts like cash, and intangible asset accounts like goodwill appear here. After a stint in equity research, he switched to writing for B2B brands full-time.

A bookkeeper prepares your accounts and documents daily financial transactions, so preparing these statements would fall naturally within their scope of work. The four main types of audit opinions are unqualified, qualified, adverse, and disclaimer of opinion. An unqualified opinion indicates that the financial statements are fairly presented and comply with the relevant accounting standards. The balance sheet, also known as the statement of financial position, presents a company’s assets, liabilities, and stockholders’ equity at a specific point in time. Your assets are items of value and things that your business owns. Current assets are items of value that can convert into cash within what is a debit and credit bookkeeping basics explained one year (e.g., checking account).